The sport of professional baseball provides those glamorous aspects of life, but it comes with more perks than that. It also has a suite of benefits and compensation plans to ensure players are financially secure when their playing days are over. Central to these advantages is the MLB baseball pension plan, a formal retirement initiative that allows ex-players to retire with financial security long after their days on the field are over. If you are wondering how these pensions function, who is eligible for one, and what sort of financial cushion they receive, we are here to break it down.

The Pension Basics:

The pension plan for MLB players has seen many changes across the decades, but its core goal is unchanged: to benefit players for their time and contributions on the field. Professional athletes often have relatively short careers compared to other fields. And while a long and storied career is what fans probably associate with, the average player’s career in the league is often much shorter. The MLB retirement pension is an important safety net.

Players must attain several years of playing time, known as service time, to qualify for an MLB retirement plan. Traditionally, players had to spend at least four years in service time to earn a full pension. But a change adopted in 1980 rewrote the rules, so that the Active List for a mere 43 days of a player’s career gains him lifetime access to the M.L.B.’s health coverage, and a decade of service entitles him to the most lucrative pension benefit.

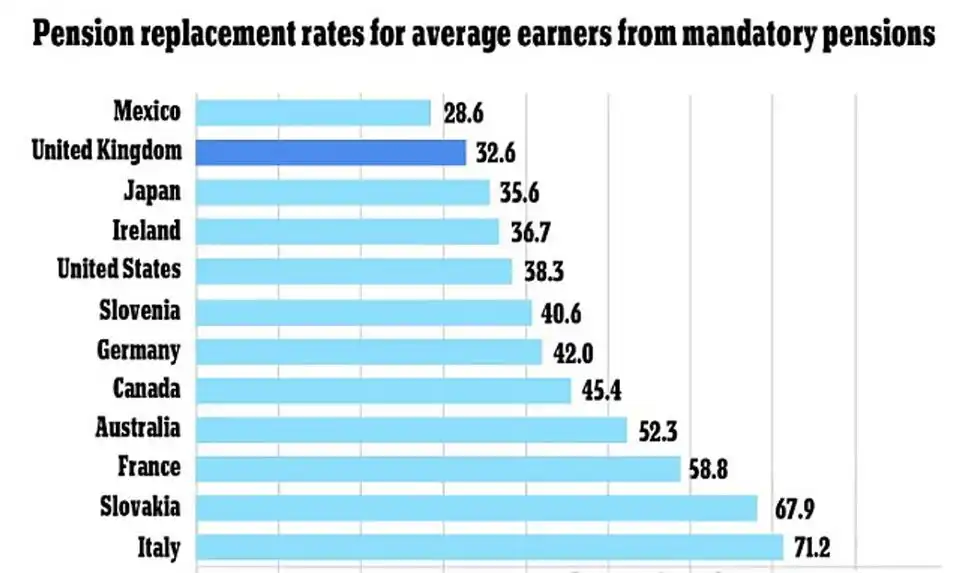

How the MLB Pension Compares:

MLB’s pension system is widely seen as one of the more generous retirement plans among professions in sports or otherwise. According to figures from the league, a player who retires after a single season in the majors can begin receiving benefits at 62. Still, players who stay in the league for 10 years or more could be eligible for a sizable monthly check. The real numbers vary by how many years a player played in the league, the Major League Baseball salary average and other factors.

These calculations account for the league minimum salary, the lowest player’s salary in the majors. As that league minimum has grown over time, so too have the baseline benefits for retired players.Learn more about how many players are on a baseball team and how roster rules can influence careers and benefits.

Factors Affecting MLB Salaries and Benefits: From Paychecks to Pensions

Understanding the pension plan helps to understand the impact of player salaries and contracts on these retirement benefits. For instance, although the headlines often highlight the multimillion-dollar deals signed by top players, many players are much closer to the Major League Baseball league minimum. These more modest earnings still yield a sizable pension benefit, though. And for players who repeatedly reach service time hurdles, these benefits accumulate and do so due to the time they commit to their craft.

To read about “how much do MLB players make?”. The answer varies widely. But regardless of salary tier, all players with enough service time become eligible for pension benefits that can boost income after their playing careers are over.

Eligibility and Contribution Details:

One of the most frequently asked questions is “When do baseball players retire?” There’s no simple answer. Some retire in their mid-30s, while others have been able to keep their careers going into their 40s. An average MLB retirement age ends somewhere between ages 30 and 35, though a few legends linger past that.

However, regardless of when a player retires, his pension contributions are based on his years in the league. The longer the career, the stronger the retirement benefits. These pensions are an integral piece of the financial plan for other Major League Baseball players. The league’s union, the MLBPA, never stops negotiating on behalf of its members to enhance such benefits.Learn how even nuances like bat rolling or statistics such as WHIP in baseball factor into a player’s performance and value.

Conclusion:

The pension for MLb players is more than a financial perk — it’s a lifeline for major baseball players, one that guarantees their careers in pro baseball will yield dividends long after the final swing. In an era as much defined by player contracts and league policies as anything else, the pension plan also remains a vital component of MLB’s pledge to its athletes. For aging stars at the end of their rope and fans who wonder what happens after the last pitch is thrown, knowing about the pension plan sheds a little light on how baseball’s top stars and little-known players prepare for life after the game.

FAQs:

What exactly is the pension plan for MLB players?

The Major League Baseball Pension Plan is a retirement plan that provides financial resources to former players who have met specific service time requirements in Major League Baseball. Healthcare benefits are available to those with as little as 43 days of service time, and a longer service time can result in more extensive monthly pension checks.

How does MLB’s retirements plan stack up against other leagues?

MLB’s pension system is generally considered one of the most generous of all professional sports. Other leagues offer pensions, too, but the pension structure, tier of benefits, and eligibility requirements make it different from other such plans in Major League Baseball.

How much is a MLB retired player’s pension worth?

The player’s pension based on several elements, including total years served, a final salary of major league baseball player, and collective bargaining agreements negotiated during a player’s career.

What is the earliest age that MLB players can start collecting their pension payments?

Baseball MLB players generally become eligible for major league baseball pension benefits at age 62. However, their specific age and amount vary based on their years of service and other time-based variables.

What is the minimum Major League Baseball salary?

The MLB minimum salary is about $740,000 as of 2024.